Important Information about Your FDIC Insurance Coverage for Dummies

Little Known Facts About FDIC Insurance - Sandy Spring Bank.

Federal government websites frequently end in. gov or. mil. Before sharing delicate info, make certain you're on a federal government site.

Insured Deposit Accounts

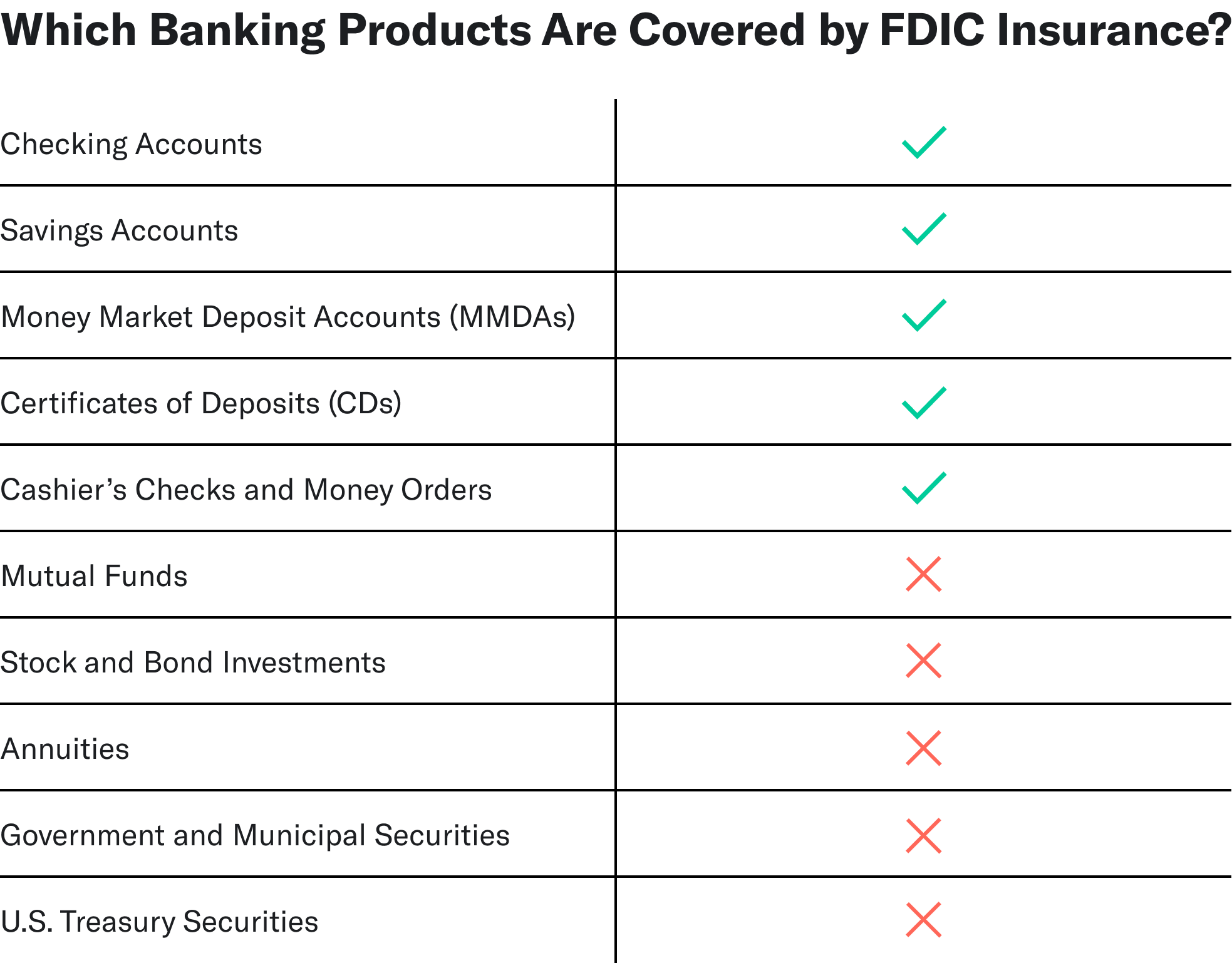

A Guide to What Is and Is Not Safeguarded by FDIC Insurance Coverage So - you feel your money is safe and safeguarded when you walk through the door of the bank or saving association, much safer than when you kept it under your bed mattress. And This Is Noteworthy should. BUT, are your funds all covered by FDIC insurance even if you strolled into a secure-looking building with iron bars and guards? Not always - it depends upon which of the bank's products you choose to use and whether the bank is FDIC guaranteed.

Banks also might use what is called a money market deposit account, which makes interest at a rate set by the bank and usually limits the client to a particular variety of deals within a mentioned time duration. All of these types of accounts generally are guaranteed by the FDIC as much as the legal limitation of $250,000 and in some cases a lot more for special type of accounts or ownership classifications.

FDIC Insurance – How it Works and Why it Matters - Live Oak Bank

See This Report about FDIC: Federal Deposit Insurance Corporation

Unlike the traditional monitoring or cost savings account, however, these non-deposit investment items are not guaranteed by the FDIC. Mutual Funds Financiers sometimes prefer shared funds over other financial investments, perhaps since they hold guarantee of a higher rate of return than say, CDs. And with a mutual fund, such as a stock fund, your risk - the danger of a company declaring bankruptcy, resulting in the loss of financiers' funds - is more spread out because you own a piece of a great deal of business rather of a part of a single business.

FDIC Insurance Information, FDIC Insurance Coverage, FDIC Insured Bank - Magyar Bank (New Brunswick,

Or your funds might be purchased a money market mutual fund, which might purchase short-term CDs or securities such as Treasury costs and government or corporate bonds. Do not puzzle a money market mutual fund with an FDIC-insured cash market bank account (described earlier), which earns interest in a quantity determined by, and paid by, the banks where your funds are transferred.